Address

四川省成都市高新区天府大道北段1700号

Work Hours

Monday to Friday: 9AM - 6PM

Helium industry 2022 review and 2023 forecast summary

Time:2023-01-16

Helium shortage 2022.4 in 0

• After 16 years of repeated shortages, 2022 is expected to be the year when the helium market finally transitions to abundant supply, but ….

• The explosion and fire at Gazprom’s Amur plant on January 1 will delay production in Amur until 5 and the transition to adequate supplies until 2023 or 2023.

• Several other supply disruptions occurred, exacerbating the severity of helium shortage 4.0

• 2022 is another year of shortages, supply allocation, and price increases

• The supply situation has improved slightly since the resumption of BLM

Gazprom – Amur Gas

• The Amur project will be the single largest factor affecting the helium market during the period 2023-2027

• Helium will be extracted from natural gas and transported to China via the 3000 km long “Power of Siberia” pipeline

• The first phase is expected to produce 3 × 750 MMCF/year

• Entered into offtake agreements with Linde, Air Products, Air Liquide, Matheson & Messer

• Will be a very low-cost (less than $200/MCF) product until the initial price reopens, as pricing was established before helium shortage 3.0, an inflation-based index index

• Helium will not be produced until the end of 2022 – may restart in Q2023/Q<> <>

• The restart time has been postponed due to the war in Ukraine

• Logistics are more challenging due to sanctions

The main factors leading to helium shortage 4.0

1. Postpone the launch of Gazprom’s Amur project

2. BLM’s crude helium concentration unit is shut down

3. Repairs are planned in Qatar

4. Algeria’s natural gas portion is diverted from LNG production to subsea pipelines to Europe

5. Dry gas exhaustion at Darwin plant in Australia

6. A fire broke out at the KS gas processing plant in Haven

Outlook for the first quarter of 2023

• The helium market remains oversold, with 5 of the 4 helium giants continuing to allocate supply

• In some cases, the distribution ratio may increase

• If BLM is capable, the worst helium shortage 4.0 should have passed

• Irkutsk Oil Company’s Yaraktinsky plant could start up in the fourth quarter –

250 MMCF/year, when it reaches full capacity – not enough to end the shortage

• Contract prices will continue to rise significantly due to cost shocks in Qatar and ExxonMobil

• Spot prices may continue to rise, but appear to have reached a plateau period

Outlook for 2023 – 2024

• Likely a year of transition to adequate supply

• EOY is expected to produce 1 or 2 Amur trains

• A recession may reduce demand, helping to balance the market

• If Gazprom can reliably produce from two trains on the Amur, the supply should be adequate

• Given the uncertainty of Ukraine and sanctions, this is not a sure thing

• High uncertainty and low confidence in forecasting

• Depends on the time and scale of Amur production

The impact of the Ukrainian invasion

• Liquid helium exports have not been sanctioned to date

• A small supply of helium in Orenburg was interrupted from the European market

• Reduced supplies from Algeria due to the diversion of natural gas to submarine pipelines

• The restart and acceleration of the Amur River project may be delayed

• Foreign technical specialists are unable / unwilling to travel to Russia

• Inability to source parts and equipment from Western suppliers

• Sanctions could prevent buyers of Gazprom’s/INK from fulfilling their contracts

• Logistics to and from the Amur River will be more challenging due to sanctions

KHeC believes that Gazprom will (eventually) be able to bypass sanctions, since China and other Asian countries that are not subject to sanctions have ready-made helium markets

• Getting an ISO container of 11000 gallons can be a hurdle

• Relatively mild short-term effects, but the duration of helium shortage 4.0 could be the impact of the Ukrainian invasion

Key trends and factors for the market

• Moderate demand growth driven by semiconductor manufacturing and aerospace

• Significant cost shocks from ExxonMobil and Qatar Gas customers provided a catalyst for sharp price increases

• Increased interest in developing private warehousing facilities as companies lose confidence in BLM systems and prepare for BLM post-production

• Helium specialist companies still dominate supply, but…

• Smaller gas companies are increasingly buying containers and seeking to buy helium directly from producers

• An unprecedented number of helium exploration start-ups

• Ukraine/Amur River has increased concerns about geopolitical risks

• Climate change initiatives involving helium business – “Green Helium”

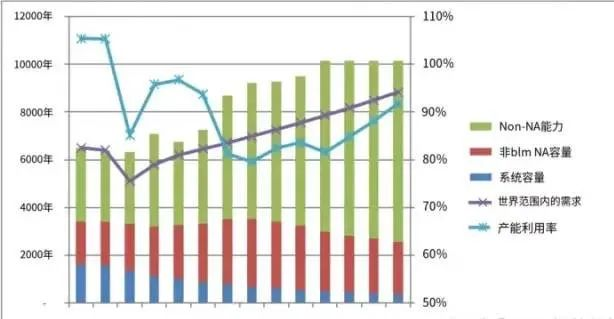

Supply, demand and capacity utilization 2018-2031

Helium supply by country – 2018 – 2026

Projected new supply – 2022 – 2026

Forecast summary and conclusion

• The helium market experienced a helium shortage of 4.0 due to explosions and fires removing Amur supplies from the market and other supply disruptions

• If/when Amur production makes a significant contribution to supply, an improvement should occur in 2023

• The pipeline for new supply projects is strong and capacity utilization should return to comfortable levels and remain there after the Amur River ramp-up

• Driven by new fab construction, demand is growing at a rate of 2-4% per year, with electronics overtaking MRI as the primary application

• Prices continued to rise through the first quarter of 2023 to ration supply and pass on cost increases to end users

• When the Amur River supply enters the market, the price should be moderate